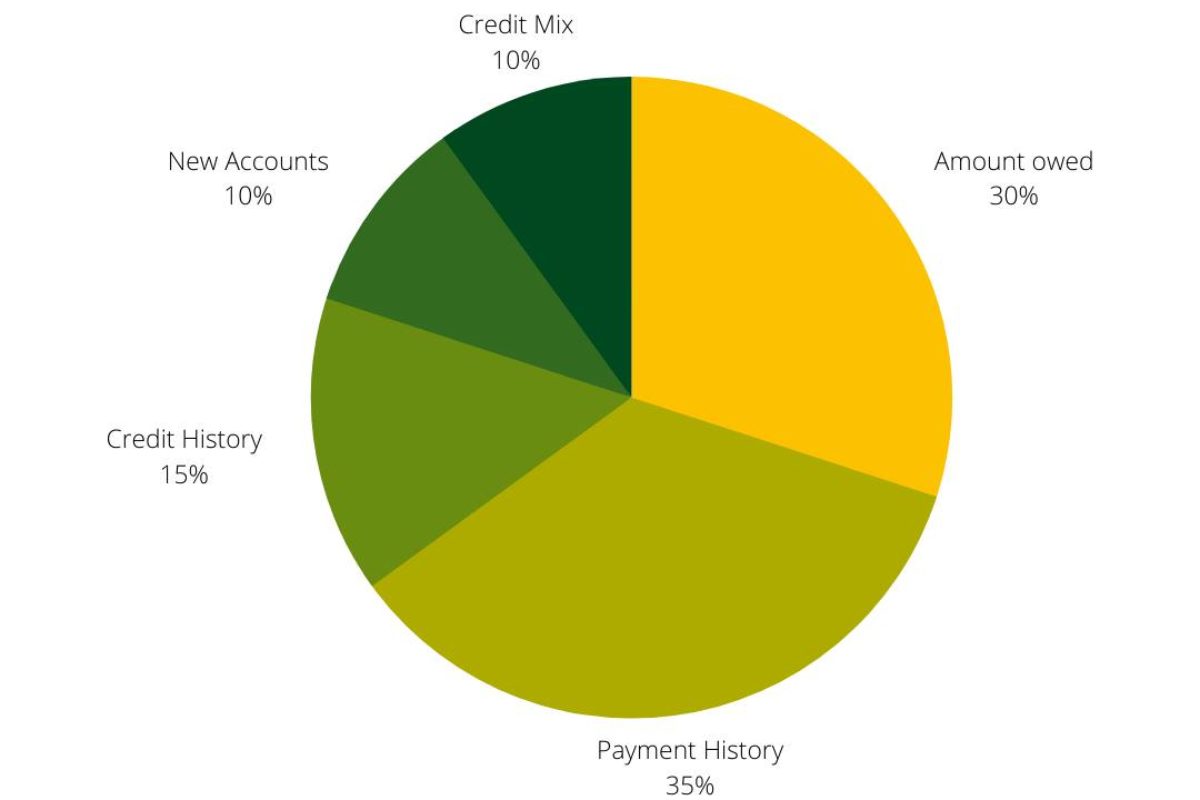

When it comes to getting pre-approved and getting a great mortgage rate, your credit score is super important. But do you know how your FICO credit score is calculated?

As you can see in the above graph, your payment history and the amount of debt you still owe make up over half of the score. That means that when you start paying on time and paying down your debt, you’ll see a big change in your credit score.

Then credit history makes up 15% of your score—this is based on the age of your accounts. The longer you’ve had the accounts open, the better your score. Opening new accounts can impact 10% of your credit score, so make sure to open new lines of credit very strategically.

The last thing your credit score is based on is the mixture of accounts. You want to vary the types of accounts you have open between short-term (like credit cards) and long-term accounts (like car or home loans).

And there you have it! Everything that goes into your credit score.

Want to know how to boost your credit score and get it ready for buying a home? The best way is to talk to a lender or credit repair person, not all debt is treated the same. Paying off certain debts will hold more weight and can help you increase your credit score faster. Speak with a professional, and if you are not sure where to start, I can help!

If you have questions, contact me, I am a source of knowledge and can guide you in the right direction.