If you’re buying a home, you’re likely going to pay some closing costs. And bad news, those closing costs can pack a wallop. Typical closing costs can range from 2-5% of the home’s purchase price. For a $350,000, you could pay anywhere from $7,000 to $17,500 Closing costs for the buyer usually ... Continue Reading » about Don’t forget to budget for closing costs!

Real Estate

Debt to Income Ratio

Remember third-grade math when they taught us about ratios? No? Don’t worry, they’re not too bad. And this is one ratio you definitely want to know because it determines just how much mortgage you get. Your debt to income ratio, or DTI, is just what it sounds like: it’s your monthly debt compared ... Continue Reading » about Debt to Income Ratio

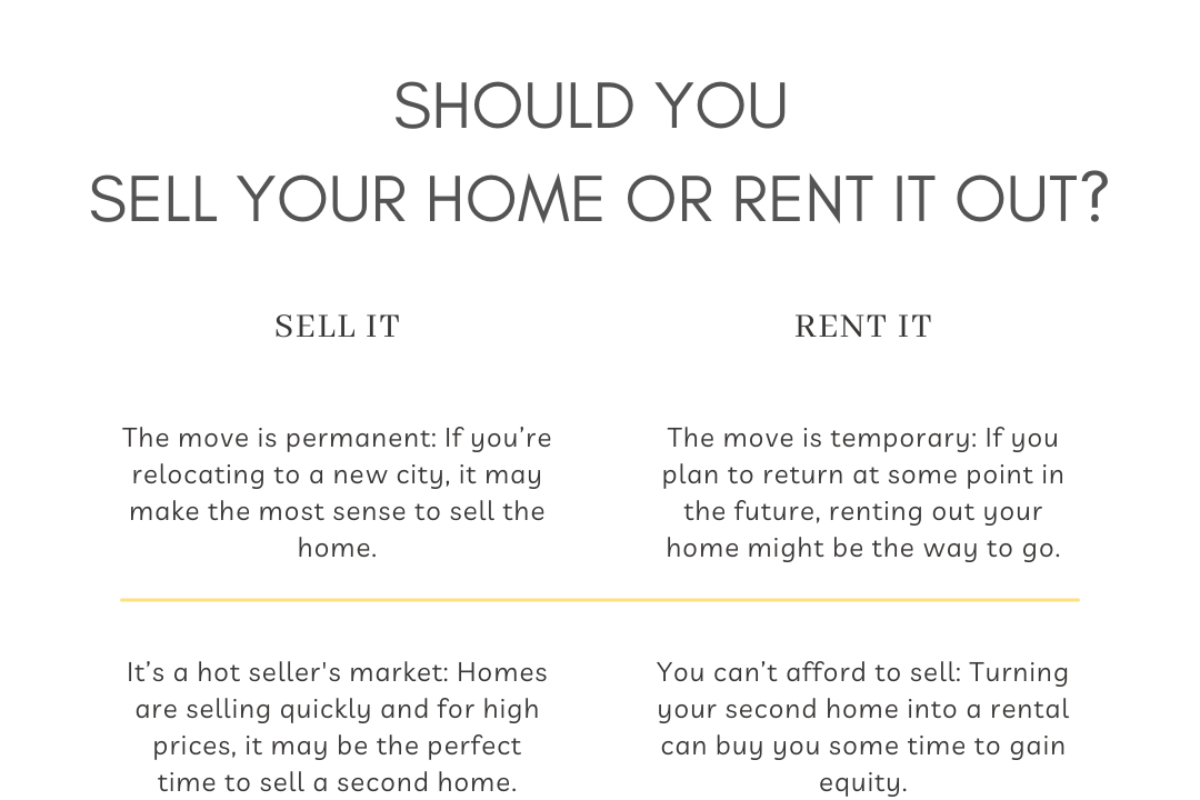

Is it better to sell or rent out right now?

“Is it better to sell or rent out right now?” ← I’ve been getting this question a lot lately, so let’s talk about it! Right now, we’re obviously in a seller’s market. That means that there’s high demand from buyers and low supply. AKA you can make a HUGE profit if you sell right now. But renting ... Continue Reading » about Is it better to sell or rent out right now?

Buy A Home You Love. With No Regrets.

When you’re making the biggest purchase of your life, buyer’s remorse is the last thing you want. But it’s something so many home buyers face. Here’s how you can avoid it. 1. Get clear on your non-negotiables. Everyone has those things that they have to have in a house. Maybe for you it’s two ... Continue Reading » about Buy A Home You Love. With No Regrets.

How to Organize Your Garage

Garages get cluttered fast, especially after an eventful summer season. Now is the perfect time to organize your garage before the colder months to make it a super usable space. 1. Declutter. To truly organize a space, you have to get rid of the clutter. Pull everything out and get honest with ... Continue Reading » about How to Organize Your Garage

How to Refinance Your Home for First-Time Homeowners

Refinancing is a scary thing for many first-time homeowners. But it doesn’t need to be, and it can save you a ton of money. Basically, when you refinance, you replace your current mortgage with a new one at a lower interest rate. A lower interest rate can save you money and can help you pay off your ... Continue Reading » about How to Refinance Your Home for First-Time Homeowners