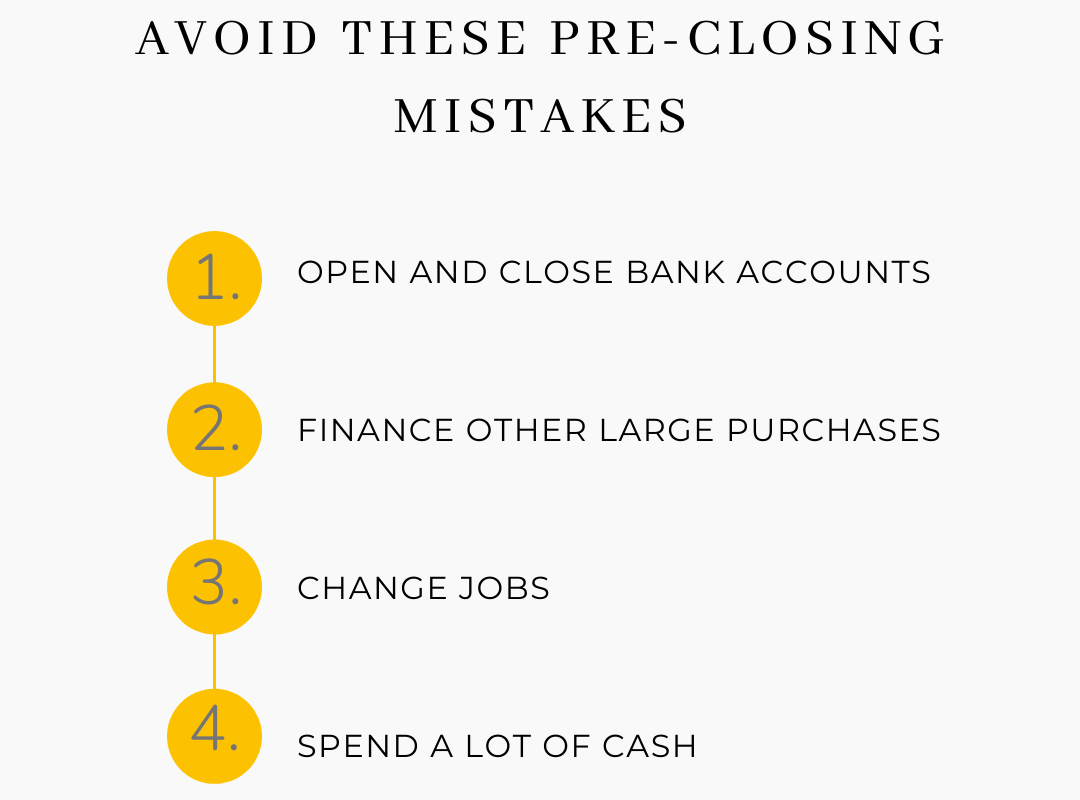

Stay far away from making any of these mistakes… Because they could spell doom for your real estate dreams!

After you’ve worked so hard to save your down payment and get your finances ready to buy a home, you don’t want to mess up your chances of getting your mortgage approved at the last minute. That means avoiding anything that could mess with your credit like closing or opening credit cards or bank accounts and getting a car loan or other big loan.

You’ll also want to avoid activities that can trigger a red flag for your lender like spending a lot of cash all at once (they’re going to ask why) or changing jobs. Changing jobs is especially risky because your lender might think you aren’t able to keep a steady stream of income, which is bad news for getting approved. After you get pre-approved, just play it safe when it comes to your finances. Limit your spending, keep your job, and keep your accounts open. Then you won’t have any problems closing on the home of your dreams!

Want more buyer tips like this one?

Just send me an email to get a FREE copy of my buyer guide!