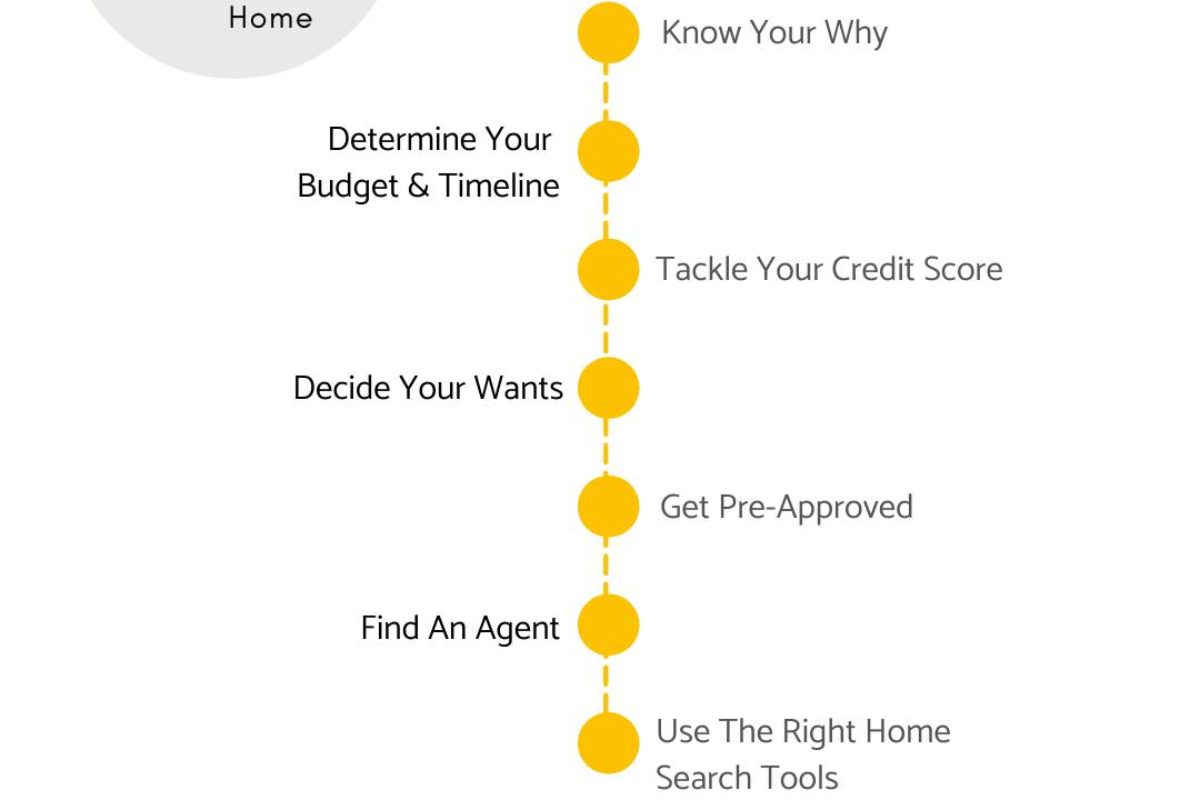

Renting has its perks, but nothing compares to owning your own home. If you’re ready to leave renting behind, follow these 7 steps:

1. Know your why: Are you outgrowing your space or are you tired of throwing money away? Buying a home can be filled with obstacles.. Before you start looking, make sure you’re committed to your why. When you have clear reasons and goals, you’ll stay on track.

2. Determine your budget and timeline:You need to know how much you can spend. And the best way to do that? Talk to a lender! They’ll take a look at your financial situation and help you understand your timeline.

3. Tackle your credit score:One of the first things lenders look for is a good credit score. If you’re not quite into “good” credit territory yet, don’t panic! Work on getting decreasing your credit card debt and making payments on time while you save up for your down payment.

4. Decide what you need and want in a home: This is the fun bit. But it can be HARD. You need to get crystal clear on the difference between your need-to-haves and your nice-to-haves when it comes to home features.

5. Get pre-approved: First, find a lender you like. Hot tip: most agents have tried-and-true lenders, so they can be a great place to start! Your lender will look at your finances, tell you how much home you can afford, and give you the pre-approved stamp of approval.

6. Find an agent: Once you’re pre-approved and know exactly what you’re looking for, it’s time to bring in an agent. Your agent will be your real estate BFF.

7. Familiarize yourself with your agent’s search tools: Your agent has access to loads of tools to make your life easier! Use their MLS search tools and their resources to find listings you love.

If you want even more info, I have a free buyers guide with lots of tips. DM me to request your copy.